Growing Economy

by Emmitt Barry, with reporting from Washington D.C. Bureau Staff

WASHINGTON (Worthy News) – The U.S. economy grew faster than previously estimated in the second quarter, expanding at a 3.3 percent annualized rate, the Commerce Department reported Thursday. The stronger reading points to resilient consumer and business spending despite the drag from high borrowing costs and trade frictions.

The figure surpassed both the government’s initial “advance” estimate of 3 percent and the 3 percent Bloomberg consensus forecast. Consumer spending, which accounts for more than two-thirds of economic output, was revised higher to 1.6 percent growth from 1.4 percent, while business investment also came in stronger. These gains offset weaker government spending and a larger import bill, which subtracts from gross domestic product (GDP).

A closely watched measure of underlying private demand–real final sales to private domestic purchasers–rose 1.9 percent, up from 1.2 percent. The data suggests both households and companies were more willing to spend than initially thought.

Inflation Trends Offer Fed Breathing Room

Price pressures cooled modestly during the quarter. The personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, rose at a 2 percent annualized rate, a touch lower than the 2.1 percent estimate. The Core PCE, which strips out food and energy, remained steady at 2.5 percent.

The revisions reinforce the Trump administration’s contention that tariffs have had limited pass-through to consumer prices, with much of the cost being absorbed by businesses and foreign producers.

Debate Over Interest Rates Intensifies

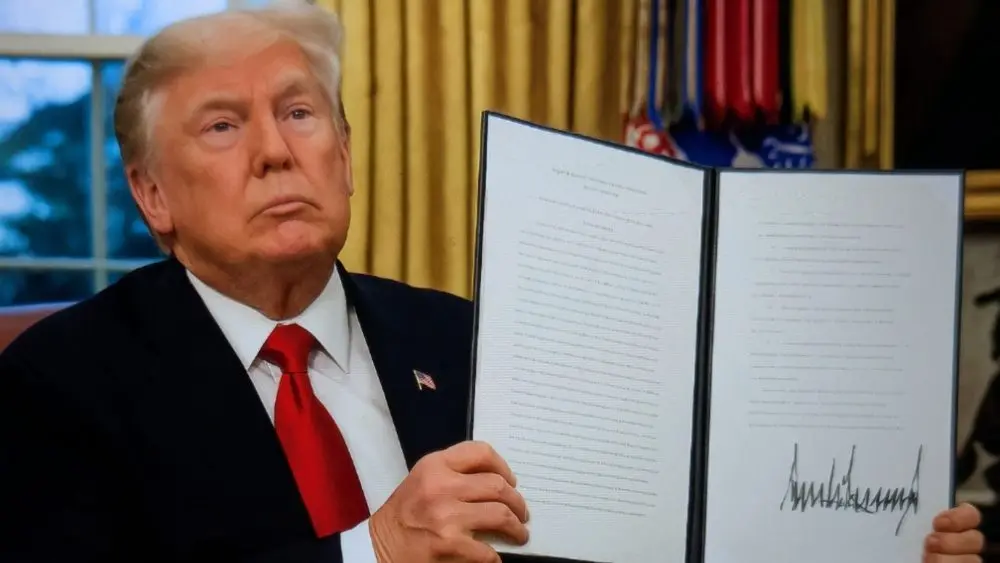

The combination of stronger demand and slightly softer inflation adds fuel to the ongoing debate over the Fed’s next steps. The central bank has maintained its benchmark interest rate between 4.25% and 4.5% since December 2024. President Donald Trump and Treasury Secretary Scott Bessent have pushed for aggressive rate cuts, arguing that lower borrowing costs would ease government debt servicing and stimulate growth.

Some analysts, however, say the latest data weaken the urgency for action. “I doubt this moves the needle for the Fed, but at the margin, these revisions work against the case for urgency to cut rates,” said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets.

Market expectations have shifted toward a more minor 25-basis-point reduction when the Fed meets in September, rather than a larger half-point cut.

Labor Market Sends Mixed Signals

The labor market remains a mixed picture. Payroll growth slowed dramatically earlier this summer, with July adding just 73,000 jobs and prior months revised sharply lower. Yet, more recent data showed resilience: initial jobless claims fell by 5,000 last week to 229,000, while continuing claims also declined.

Retail sales have also remained firm, with July up 0.5 percent following a strong June. Inflation year-on-year, however, was 2.7 percent in July–still above the Fed’s 2 percent target.

Outlook for Third Quarter

With two months of data already in, the Atlanta Fed’s GDPNow model projects the economy is on track for 2.2 percent growth in the third quarter. Analysts say the combination of steady demand, cooling inflation, and a labor market that has not cracked under pressure paints a picture of continued but moderating growth heading into the fall.

The post U.S. Economy Grows at 3.3% Pace in Q2, Easing Inflation Strengthens Outlook appeared first on Worthy Christian News.